- Low spreads from 0.0 pips

- Negative balance protection

- Comprehensive learning materials and insight

- 5 trading account types available

- Trading signals for traders

- Limited selection of currency pairs

- No cent account

- Not available to traders in the US

Tickmill is a well-established broker since 2014. Tickmill has headquarters in Seychelles, United Kingdom, Cyprus, Germany, South Africa, Malaysia and United Arab Emirates. Tickmill to provide their Forex/CFD trading services to global clients.

This broker has also been regulated by FSA (Seychelles) SD008, FCA 717270, CySEC 278/15, BaFin 146511, FSCA 49464, FSA (Labuan) MB/18/0028 and DFSA (Dubai) F007663.

Being regulated by multiple licenses provides many advantages, one of which is account protection by the Financial Services Compensation Scheme (FSCS) up to a maximum deposit value of £85,000. This is in accordance with the Financial Instruments Directive 2014/65/EU or MiFID II, as well as the European Union’s 5th Anti-Money Laundering Directive. The Investor’s Compensation Fund (CIF), as per EU Directive 2014/49/EU, protects deposits of up to €20,000. All deposits remain completely separate from company accounts, plus negative balance protection is in place.

Founded in 2014, Tickmill Group has experienced tremendous growth. Regulated in three jurisdictions, it has over 111,000 traders with over 263,000 accounts. The company managed more than 215 million transactions, not to mention the average monthly trading volume that managed to surpass $123 billion. This CFD broker employs more than 150 staff members worldwide to run its business well while continuously improving trading conditions as best as possible so as not to disappoint clients.

Tickmill Summary

| 🔎 Broker | 🥇 Tickmill |

| 📌 Year Founded | 2014 |

| 👤 Amount of Staff | Approximately 100 |

| 👥 Amount of Active Traders | Over 100,000 |

| 📍 Publicly Traded | None |

| 📈 Regulation | FCA, CySEC, FSA |

| 📉 Country of Regulation | UK, Cyprus Seychelles |

| 📊 Account Segregation | ✅Yes |

| 💹 Negative Balance Protection | ✅Yes |

| 💱 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | 5+ |

| 💶 Minimum Deposit | $100 |

| ⚡ Average Deposit/Withdrawal Processing Time | 1-2 business days withdrawals |

| 💵 Fund Withdrawal Fee | Generally free |

| 📌 Spreads From | 0.0 pips (ECN accounts) |

| 💷 Commissions | Variable |

| 🔢 Number of Base Currencies Supported | Over 50 |

| 💳 Swap Fees | Applicable |

| ⭐ Leverage | Up to 1:500 (Forex trading) |

| 📍 Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 🖥️ Order Execution Time | Milliseconds |

| 💻 VPS Hosting | Available for a fee |

| 📈 CFDs – Total Offered | 80+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank transfer credit/debit e-wallets |

| 💶 Withdrawal Options | Bank transfer credit/debit e-wallets |

| 🖥️ Trading Platforms | MetaTrader 4 (MT4) MetaTrader 5 (MT5) |

| 🖱️ Forex Trading Tools | Advanced charting, market analysis tools |

| ⭐ Customer Support | ✅Yes |

| 🥰 Live Chat Availability | ✅Yes |

| ☎️ Customer Support Contact Number | +44 20 8089 0385 |

| 💙 Social Media Platforms | Facebook, Twitter, LinkedIn |

| ⚙️ Languages Supported on Tickmill Website | Multiple |

| ↪️ Education and Research | ✅Yes |

| 📔 Forex Course | ✅Yes |

| ✏️ Webinars | ✅Yes |

| 📚 Educational Resources | Comprehensive |

| 🤝 Affiliate Program | ✅Yes |

| 🫰🏻 IB Program | ✅Yes |

| ⭐ Do They Sponsor Any Notable Events or Teams | ✅Yes |

| 🎁 Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Account Information

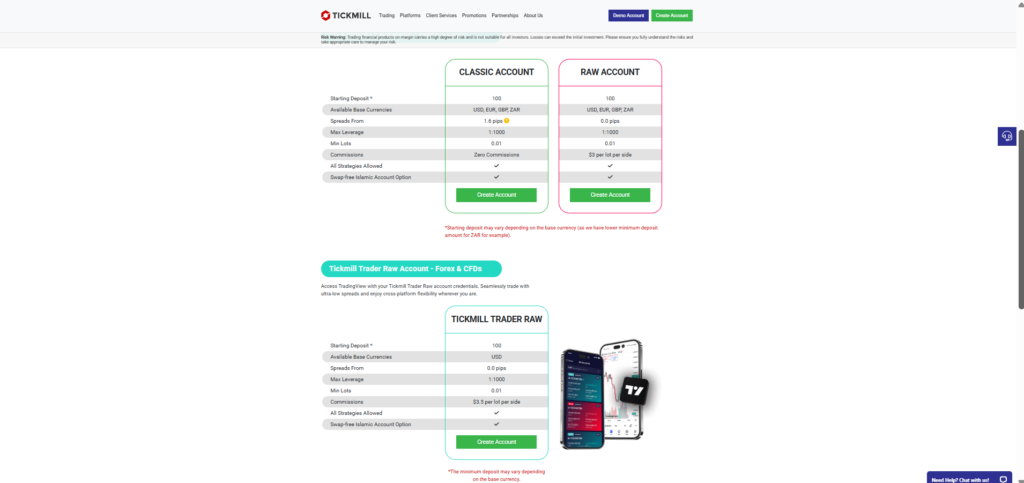

Apart from the forex demo account, this broker offers ECN Pro (EU), ECN Pro, Classic, ClassiÑ (EU), Classic (UK), ECN Pro (UK), VIP, VIP (UK) and VIP (EU). To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by Tickmill is up to 1: 1000 Meanwhile, you can open an account with a starting capital of $100.

There are 9 live accounts on offer at Tickmill:

- Classic: There is a $100 minimum deposit when you first sign up with a minimum position of 0.01 lot. Variable spreads, scalping/hedging capabilities, and Expert Advisors are available. Platform features include trailing stop, pending orders, automated trading, mobile trading, as well as mobile trading. Clients need to be aware of swap rates fees on overnight positions.

- ECN Pro: Users would need at least $100 to open an ECN Pro account. The minimum trade size is 0.01 lots. There are a number of clear benefits to the account offers, such as fixed spreads, trailing stop, pending orders, one-click trading, mobile trading, and automated trading.

- VIP: Opening a VIP account requires a $50,000 minimum deposit and a minimum trading volume of 0.01 lots. Spreads at VIP are variable. Traders can benefit from trailing stop, pending orders, one-click trading, mobile trading, along automated trading features.

- Classic (UK): Classic UK account offers a minimum deposit of $100, a minimum trading volume of 0.01 lots. They also provide variable spreads along with more advanced pending order, trailing stop options, scalping abilities, Expert Advisors, automated trading, one-click trading, and mobile trading.

- ECN Pro (UK): Users must have at least $100 in their trading account and execute a minimum of 0.01 lots. ECN Pro UK uses fixed spreads. The account boasts an intuitive interface with automated trading, mobile trading, one-click trading, Expert Advisors, and scalping capabilities. They also provide trailing stop and pending orders tools.

- VIP (UK): The minimum deposit is $50,000 with the minimum market volume lot size is 0.01. Spreads are variable at VIP UK. They also boast an impressive suite of scalping strategies, Expert Advisors, trailing stop, pending orders, one-click trading, mobile trading, and automated trading.

- ClassiÑ (EU): Tickmill offers Classic EU account for all clients with a minimum deposit requirement of $100, lot sizes of just 0.01, variable spreads, and hedging/scalping capabilities. Traders are blessed with advanced features, such as Expert Advisors, trailing stop, pending orders, one-click trading, mobile trading, and automated trading.

- ECN Pro (EU): Traders are required to deposit an initial amount of $100, lot sizes from just 0.01, and enjoy variable spreads. The platform features a wide range of Expert Advisors, scalping capability, trailing stop, pending orders, automated trading, mobile trading, and one-click trading.

- VIP (EU): VIP EU generally requires a minimum deposit of $50,000 and the minimum trade size is 0.01 lots. The account offers variable spreads scalping/hedging capabilities, Expert Advisors and provides full access to trailing stop, pending orders, one-click trading, mobile trading, and automated trading.

Fees

The Classic account operates under the market maker model with the minimum spread listed at 1.6 pips. With Pro and VIP accounts options that deploy the NDD model, commissions can be as low as $4 and $2 per lot. They have the most competitive spreads with average rates on EUR/USD pair at 0.2 pips, tough Tickmill markets both accounts with starting spreads of 0.0 pips. Tickmill also charges swap fees for holding a position open overnight. Third-party payment processor fees may apply, but a zero-fee policy exists for deposits that exceed $5,000.

Instruments Traded

Besides lots of currency pairs, Tickmill also offers some instruments you would like to trade on, such as Forex, Gold & silver, Crypto, Indices, Commodities and Bonds for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Tickmill users can trade in:

- 62 currency pairs

- 14+ indices

- Gold and silver

- 4 bond CFD

- 3 cryptocurrencies

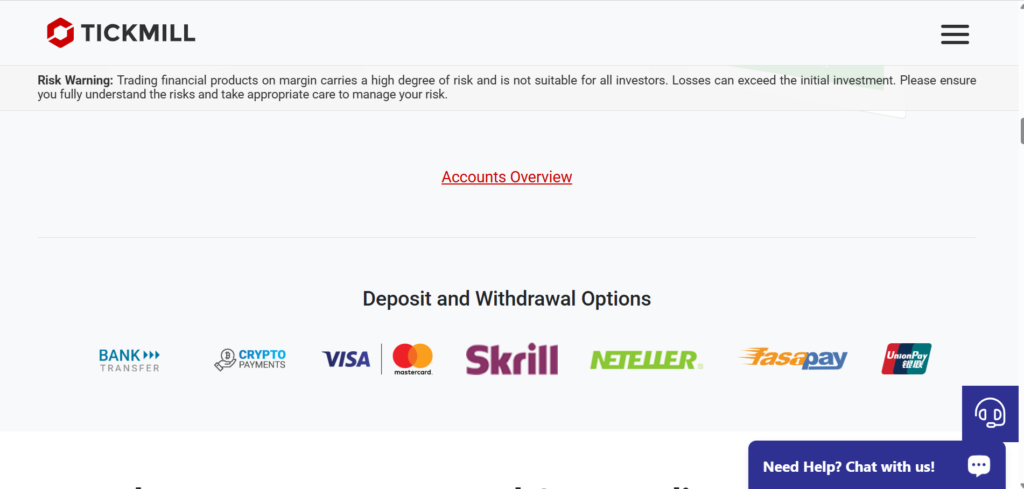

Payment Methods

Fortunately, there are a number of payment methods available, including bank wires, credit/debit cards, Skrill, Neteller, Sticpay, Fasapay, Unionpay, NganLuong, QIWI, and WebMoney. The minimum deposit and withdrawal amounts are $100 and $25, respectively. Withdrawal times are kept between instant and seven business days. There is no charge for any of the payment methods, however, a thrid-party fee may apply. Tickmill covers fees for wire deposits above $5,000, up to $100. Wire fees on deposits that exceed $5,000 are reimbursed, up to $100.

Tickmill offers a variety of payment methods via:

WebMoney : WebMoney is one of the major online wallet services which many people use to send money around the world. For this reason, there is a large number of forex brokers that accept WebMoney today. Like other online payment services today, WebMoney is supported by mobile applications to make transactions more efficient.

Wire transfer : Wire Transfer is the most commonly used payment method. Nearly all brokers in the world provide this method on their service. The reason is wire transfer is basically traditional transfer between banks in the worldwide. So, this method is guaranteed for its safety. This really helps traders who avoid third-party payments or don’t have credit cards.

Skrill : Mostly, all forex brokers provide Skrill as an online payment service option. Fast, easy, and safe transactions are the main reasons why traders using this method. Traders can use Skrill to fund their trading accounts with either payment cards, bank wire transfers, or directly from a Skrill e-wallet account.

QIWI : Qiwi is an e-wallet or electronic payment service provider from Rusia that is introduced in 2007. The service is mainly used by individuals and businesses in Russia, Ukraine, Kazakhstan, Moldova, Belarus, Romania, the US, and the UAE.

Neteller : Like PayPal, Neteller is one of the most popular online payment services today. Due to this popularity, nearly all forex brokers accept Neteller as a payment method for their clients’ fund deposit and withdrawal. Although the Neteller system is available almost all over the world, it remains particularly popular in Europe.

FasaPay : Known as an e-payment for retail forex traders, FasaPay does not require a huge amount of fee, giving it a competitive edge among any other e-payments in the forex brokerage industry. Instant process is also featured as one of its advantages.

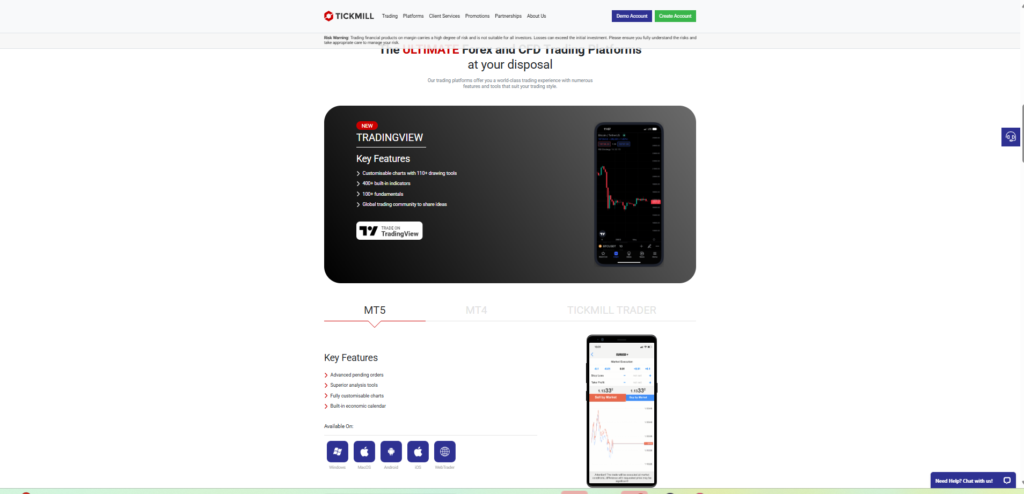

Trading Platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, a price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitability by placing well-planned trades.

Hereby, Tickmill offers you MetaTrader 4, MetaTrader 5 and Tickmill Trader.

- MT4: The MT4 trading platform is known to be up-to-date and popular in a world-class trading environment. Despite its advanced capabilities, third-party plugins are required to unlock its full functionality. Unfortunately, Tickmill only offers the most basic version of the MT4 platform.

- MT5: The MetaTrader 5 (MT5) platform offers a wide range of trading instruments, including CFDs on forex, stock indices, stocks, commodities, bonds, and cryptocurrencies. MT5 also provides advanced algorithmic applications like Expert Advisors, Trading Robots, and Copy Trading.

- Tickmill Trader: Tickmill Trader is a mobile trading platform that allows you to trade 24/7 with leverage up to 1:

10001 and spreads starting from 0.0.

Unique Features

Tickmil has a breadth of unique features:

- MT4 plugin that enables one-click trading.

- VPS hosting is provided in partnership with BeeksFX for a 20% discount on all packages.

- Social trading via Myfxbook, with the benefit of a 1.2 pips mark-up on spreads that are levied on traders on top of the pricing environment in the Pro account.

- MT4 multi-trader terminal that allows entry-level portfolio management.

- Tickmill Prime provides services to institutional clients and appears to be the most prominent product maintained.

Research and Education

Tickmill is a great brokerage for professionals and beginners due to several factors:

- The Tickmill blog is divided into many sections, such as Market Insight, Fund Analysis (referring to fundamental analysis), Tech Analysis (referring to technical analysis), and Articles. With a comprehensive look, the blog features daily trading updates, along with a solid mix of written, graphic, and video content.

- Autochartist complements the analysis provided by Tickmill experts. It is useful for scanning the market independently for predefined patterns, alerting traders of potential upcoming opportunities. Three calculators are available that allow manual traders to calculate margin requirements and pip values.

- Tickmill’s eleven financial experts provide excellent financial market coverage.

- Webinars are held weekly and cover a wide range of topics.

- Tickmill also holds seminars globally introducing Forex trading to new and potential clients each year.

- Two ebooks are available for download.

- There is a library of video tutorials in English, Spanish, German, Arabic, and Russian.

- The broker also offers a glossary where basic terms are explained in short sentences.

Bonuses and Promotions

At the time of writing, Tickmill does offer 4 deposit bonuses and promotions:

- The Trader of the Month promotion requires no sign-up as every live account participates. $1,000 is awarded to the winner, but it remains unclear if this is a cash price or a non-withdrawable deposit into the trading account.

- Tickmill offers global clients a prize of either $200 or $500 (dependent upon the accuracy of the guess) if they manage to be the NFP Machine winner, a contest held during NFP week each month.

- There is also a $30 deposit awarded to the new clients, which cannot be withdrawn, but any profits generated are for traders to keep.

- A four-month-long contest focused on referrals, known at Tickmill as the IB contest (Introducing Broker) is also held annually. The prize for the winner is either a complete travel package to London, New York, and Singapore, or else one of over $10,000 (equivalent) in prizes.

Customer Support

Do you have any question or find any trouble related to Tickmill? If you do, you should reach Tickmill’s support to get the information that you need. Here is the detail of the broker’s customer support: Support is available 24/5 via e-mail Tickmill, webform, call, or live chat function. There is an FAQ section answers the most basic questions.