The XM broker was founded in 2009 by a group of interbank dealers looking to expand the forex market’s services. In our XM review, we see that the company has transformed into a broker with many online assets. It has headquarters in the Republic of Cyprus and is registered under the name Trading Point of Financial Instruments Ltd.

XM Group (XM) is a group of regulated online brokers. Trading Point of Financial Instruments Ltd was established in 2009 and it is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10), Trading Point of Financial Instruments Pty Ltd was established in 2015 and it is regulated by the Australian Securities and Investments Commission (ASIC 443670) and XM Global Limited was established in 2017 and is regulated by the Financial Services Commission (000261/397).

XM Summary

| 🏢 Headquarters | Cyprus, Australia, Belize and Dubai |

| 📆 Established | 2009 |

| 🗺️ Regulation | ESMA, CySEC, ASIC, FSC and DFSA |

| 🖥 Platforms | MT4 and MT5 |

| 📉 Instruments | Instruments: Forex Trading, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies and Shares. |

| 💳 Minimum Deposit | $5 |

| 💰 Deposit Methods | Multiple local payment methods available |

| 📱 Mobile Trading | Available |

| 🌍 Web Trading | Available |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | Maximum Leverage: 1:1000 ((Note: “This leverage is not available to all the entities of the Group. The maximum leverage for clients registered under the EU regulated entity of the Group is 30:1”) |

| 🌍 ECN | Available |

| 🤖 Robots | Available |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/7 |

Account Information

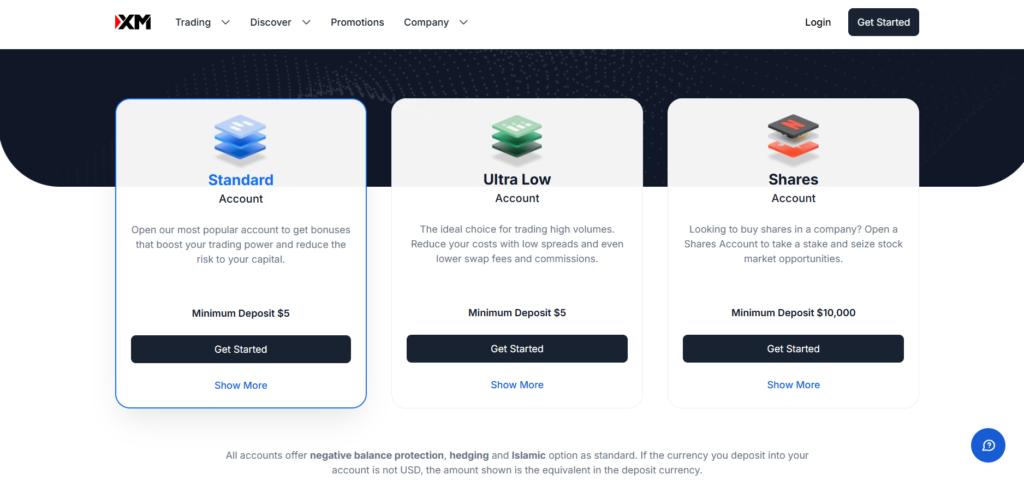

Apart from the forex demo account, this broker offers Standard, Micro and XM Ultra Low. To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by XM is up to 1: 1000 Meanwhile, you can open an account with a starting capital of $5.

There are 3 main account types available at XM:

- Micro: The minimum initial deposit in the Micro account is $5. The minimum trade size is 0.1 lots. Spreads are variable at this account type. Micro Account offers mobile trading, automated trading, one-click trading, pending orders, and trailing stops. This account allows for Expert Advisors, hedging, scalping techniques, and plenty of other strategies.

- Standard: The minimum initial deposit is $5 and the minimum trade is 0.01 lots, same as Micro, making the account attractive to beginners. Standard type offering variable spreads across a wide range of markets. You can manage risk with trailing stop losses and pending orders. Many reviews suggest the best part of Standard type is the range of additional resources, such as one-click trading, mobile trading, automated trading, Expert Advisors, and scalping plus hedging strategies. Note that this account charges swap.

- XM Ultra Low: The minimum payment is $5. XM offers two types of Ultra-Low account type with different minimum trade size, Standard Ultra-Low (minimum trade size 0.01 lots) and Micro Ultra-Low (minimum trade size 0.1 lots). Ultra Low option offers variable spreads across major Forex pairs. The account does offer mobile trading, automated trading, one-click trading, trailing stop, and pending orders. Traders can analyze markets and price dynamics using Expert Advisors. Hedging and scalping also allowed.

Fees

XM is transparent with its fees. In order to see what trading at XM will cost, you can read below:

- Forex Fees

– Ultra-Low Standard Account spreads starting as low as 0.6 pips for EUR/USD and USD/JPY, while other currency pairs have higher mark-ups, ranging closer between 1.5 pips and 2.0 pips for the most traded currency pairs and well above that for minor and exotic ones.

– The commission-free Standard account offers spreads at around 1.6 pips with an average of 1.7 pips or $17.00 per 1.0 standard lot for EUR/USD. - Stock Fees

Commission starting from $0.04 per share is applied to US stocks, twice as high better-priced options, but the minimum cost of $1 per transaction ranks among the lowest. For the UK and German shares, the minimum stock fee $9 and $5 per order. - CFD Fees

Spreads start at 0.7 pips for the S&P 500 and approximately $0.30 and $0.03 spreads for the gold and silver respectively. XM lists WTI Crude Oil with a minimum of 0.04 pips and the minimum price fluctuation as 0.01 pip or $1.00. For corn, both values are 0.0275 and $0.04. - Non-Trading Fees

There are no internal deposit or withdrawal charges, but traders may face third-party costs. XM covers costs for deposits and all bank wire levies from XM banks on deposits above $200. Traders may still pay charges levied from their banks. XM also lists the potential of currency conversion fees in its terms and conditions without specifying them. An inactivity fee applies after twelve months of dormancy with a monthly charge of $5.

Typical round trip costs on leading pairs EUR/USD are 0.8 pips in the XM Zero account. XM charges an account inactivity fee of $5 per month after 90 days but no additional fees on deposits or withdrawals except where an amount of less than $200 is moved by wire transfer. Other charges include overnight swap fees, which is usually a net charge applied to every trade daily.

Instruments Traded

Besides lots of currency pairs, XM also offers some instruments you would like to trade on, such as Forex, Gold & silver, CFD, Oil, Crypto, Stocks, Commodities and Indices for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

XM offering access to over a thousand instruments, including:

- More than 55 currency pairs and crosses, including exotic currencies.

- 1,200 different stocks from seventeen different national equity markets, including the USA, UK, Germany, Switzerland, Australia, and Russia.

- 8 soft commodities.

- 5 energies including natural gas.

- 2 metals, namely gold and silver.

- 18 major equity indices.

Payment Methods

XM charges no deposit fees. However, electronic wallets such as Moneybookers, Skrill, and Neteller as well as credit cards and bank wire transfers charge $5 of the deposited amount. Moneygram and Western Union payments are also accepted.

Withdrawals can be made using the same methods. In fact, the deposit and withdrawal options are listed side by side on the website and a trader needs only click on “make a deposit” or “request a withdrawal”. Please note that withdrawals via bank wire of amounts under $200 are subject to a $15 administration fee.

For the funding of trading accounts at XM, the broker has provided support for several methods of fund transfer:

WebMoney : WebMoney is one of the major online wallet services which many people use to send money around the world. For this reason, there is a large number of forex brokers that accept WebMoney today. Like other online payment services today, WebMoney is supported by mobile applications to make transactions more efficient.

Wire transfer : Wire Transfer is the most commonly used payment method. Nearly all brokers in the world provide this method on their service. The reason is wire transfer is basically traditional transfer between banks in the worldwide. So, this method is guaranteed for its safety. This really helps traders who avoid third-party payments or don’t have credit cards.

Skrill : Mostly, all forex brokers provide Skrill as an online payment service option. Fast, easy, and safe transactions are the main reasons why traders using this method. Traders can use Skrill to fund their trading accounts with either payment cards, bank wire transfers, or directly from a Skrill e-wallet account.

QIWI : Qiwi is an e-wallet or electronic payment service provider from Rusia that is introduced in 2007. The service is mainly used by individuals and businesses in Russia, Ukraine, Kazakhstan, Moldova, Belarus, Romania, the US, and the UAE.

Neteller : Like PayPal, Neteller is one of the most popular online payment services today. Due to this popularity, nearly all forex brokers accept Neteller as a payment method for their clients’ fund deposit and withdrawal. Although the Neteller system is available almost all over the world, it remains particularly popular in Europe.

FasaPay : Known as an e-payment for retail forex traders, FasaPay does not require a huge amount of fee, giving it a competitive edge among any other e-payments in the forex brokerage industry. Instant process is also featured as one of its advantages.

Cash : If you live in the Middle East, CashU is one of the most popular online payment services there. CashU is a digital wallet that allows clients to pay or transfer money online instantly and offer users its own pre-paid MasterCard with no absolutely additional fees attached. Introduced in July 2002, CashU has targeted the Middle East and North African markets where it serves close to 2.3 million customers. This is the reason why many of the forex brokers that are expanding in the North African and Middle East market accept CashU as one of their payment methods.

XM also provides payment with paysafecard, iDEAL, giropay, Western Union, UnionPay, SOFORT, Perfect money, Moneta.Ru and Credit/debit cards.

Trading Platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, a price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitability by placing well-planned trades.

Hereby, XM offers you MetaTrader 4, MetaTrader 5, Social Trading and Web.

-

- MT4: XM offers the widely used MetaTrader 4 trading platform available on Mac as well as on mobile devices such as Androids and iPhones, iPads, and tablets. The easy-to-use platform caters to both novice and experienced traders and offers a range of customizable features, including over 100 Instruments including Forex, CFDs, and Futures, 1 login access to 8 platforms, spreads as low as 1 pip, full EA (Expert Advisor) functionality, 1 click trading, technical analysis tools with 50 indicators and charting tools and 3 different chart types.

XM also offers the MT4 Multiterminal platform for traders wanting to handle multiple MT4 accounts from 1 single terminal with 1 Master Login and Password. As for the online solution, WebTrader 4, enables users to execute trades instantly from their PC or Mac with no download required. The browser-based terminal proposes the same features as the downloadable platform, such as 100 Instruments Including Forex, CFD’s and Futures, 1 single login access to 8 Platforms, spreads as low as 1 pip, 1 click trading, and built-in news functionality. - MT5: As the successor to MT4, users benefit from a more professional experience with MT5 and additional capabilities, including different order types such as ‘Fill or Kill’ and ‘Immediate or Cancel’ as well as technical and fundamental analysis using over 79 analytical tools. The MT5 WebTrader provides the same functions as the desktop client but does not require downloading a trading terminal.

- MT4: XM offers the widely used MetaTrader 4 trading platform available on Mac as well as on mobile devices such as Androids and iPhones, iPads, and tablets. The easy-to-use platform caters to both novice and experienced traders and offers a range of customizable features, including over 100 Instruments including Forex, CFDs, and Futures, 1 login access to 8 platforms, spreads as low as 1 pip, full EA (Expert Advisor) functionality, 1 click trading, technical analysis tools with 50 indicators and charting tools and 3 different chart types.

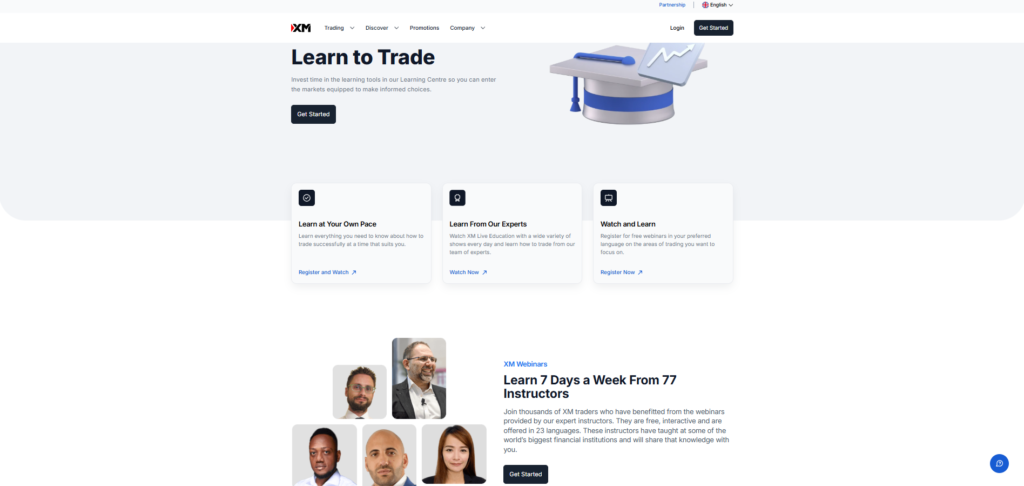

Research and Education

XM has an exceptional research and education center. It may be the best one we’ve ever seen, complete with news and analysis on key markets and relevant geopolitical developments, including technical analysis performed on ed price charts. Forex, commodities, and stocks are also covered.

Below are a handful of additional resources that can be found at XM’s research and education sections:

- Educational room is live trading rooms which clients may enter and participate in and see live markets traded in real-time.

- Seven educational videos on a range of common Forex trading topics.

- The list of video tutorials covers topics as basic as how to open a Forex account to how to use an MT4 Droid pad on the Mobile Trader app.

- Account-holders can benefit from weekly webinars in 13 different languages.

- Upcoming XM workshops and seminars.

- Their economic calendar posts any upcoming events taking place in markets throughout the world.

- There are market reviews, a Forex news report, and technical analysis that appear daily.

- Free forex signals and forex calculators.

Bonuses and Promotions

At the time of writing, XM promotes:

- Free VPS for clients who maintain a balance (Equity-Credit) USD 5,000 or currency equivalent.

- $30 Non-Deposit Trading Bonus for new clients only.

- 50% deposit bonus up to $500 and 20% deposit bonus up to $5,000.

- XM Loyalty Program offers the clients XM Points (XMP) per lot traded. These XMP can be redeemed at any time for a credit bonus which can be used for trading purposes only.

Bonuses and Promotions depend on the country and the Entity of the Group. Due to AU and EU regulations, XM does not offer any Trading Bonuses and Loyalty Programs to retail traders within Europe and Australia.

Customer Support

Do you have any question or find any trouble related to XM? If you do, you should reach XM’s support to get the information that you need. Here is the detail of the broker’s customer support:

XM’s customer support team is available at different departments in several international locations via email, telephone, or live chat 24 hours a day, from Monday to Friday. The representatives speak in all the following languages: English, Greek, Japanese, Chinese, Bahasa Malay, Bahasa Indonesia, Hungarian, Russian, French, Spanish, Italian, German, Polish, Hindi, Arabic, Korean, Portuguese, Czech, Slovakian, Bulgarian, Romanian and Dutch.