- Wide Range of Assets

- Innovative Trading Platform

- Low Spreads

- High Leverage

- Educational Resources

- Regulated Broker

- Limited Availability in Some Regions

- Withdrawal Fees

- Complex for Beginners

- High Minimum Deposit for Certain Accounts

- Limited Customer Support

ThinkMarkets is a well-established broker since 2010. ThinkMarkets has headquarters in Australia, United Kingdom, Japan, South Africa and Seychelles. ThinkMarkets to provide their Forex/CFD trading services to global clients.

This broker has also been regulated by ASIC 424700, FCA 629628, FSA (Japan) 0250, FSCA FSP No 49835, FSA (Seychelles) FRN No SD060 and CySEC 215/13.

International clients usually trade under the FSA regulation of the Seychelles, TF Global Markets Int Limited. While the payment processor for all subsidiaries, TFG (Payments) Limited, is registered in the United Kingdom.

Founded in 2010, ThinkMarkets is a multi-asset brokerage based in Australia and the UK with dual headquarters in Melbourne and London, as well as regional offices throughout the Asia-Pacific region, the Middle East, North Africa, Europe, and South America.

Although the data shows that 71.89% of retail traders lose money on ThinkMarkets per UK unit, the security of the broker deserves a thumbs up. ThinkMarkets separates client deposits from corporate funds, as mandated by regulators. The best protection provided by this broker is the separately obtained insurance policy of up to $1,000,000 in case of bankruptcy. Traders looking for a safe and secure multi-asset broker will feel comfortable trading at ThinkMarkets.

Account Information

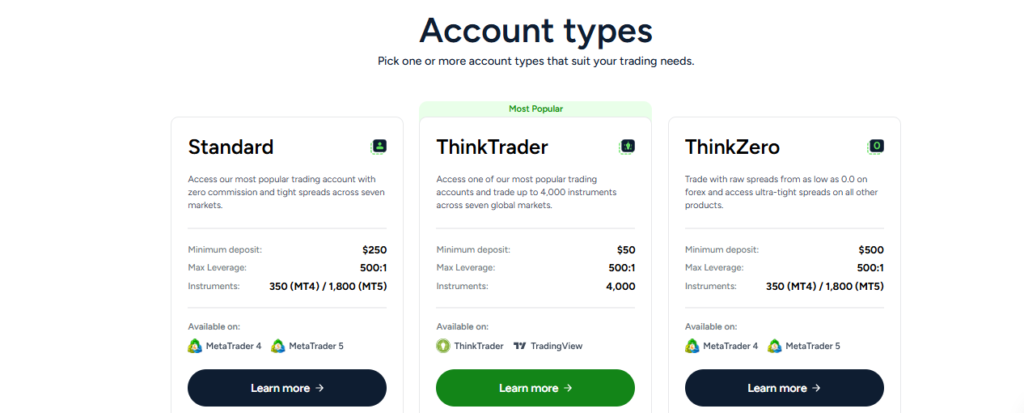

Apart from the forex demo account, this broker offers Standard and ThinkZero. To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by ThinkMarkets is up to 1: 500 Meanwhile, you can open an account with a starting capital of $0.

ThinkMarkets offers two types of live account:

- Standard: The Standard account offers the lowest deposit of just $0. The minimum lot size is 0.01 lots. It also allows you to use hedging, and scalping. Traders are able to easily build their own trading strategy, with pending orders, OCO orders, and one-click trading options. Traders can experience variable spread and browser-based platforms, but this account charges overnight swap fees.

- ThinkZero: There is a minimum deposit of $500 and execute a minimum of 0.01 lots. You are allowed to trade assets with variable spread. Expert Advisors, hedging, as well as scalping, are also permitted. The trading platform boasts an intuitive interface with automated trading, mobile trading, and one-click trading, which also offers dozen of tools, such as trailing stop and pending orders. There are swap rates for holding overnight positions.

Fees

ThinkMarkets Standard account is commission-free but charges a 0.4 pip mark-up. ThinkZero account spreads are around 0.0 with an average of 0.1 pips but charge commission of $3.50 per lot. Clients should be wary of hidden fees such as swap charges on overnight positions. The broker does not usually charge inactivity fees, yet reserves the right to do so. ThinkMarkets does not charge market data fees nor third-party payment processors.

Instruments Traded

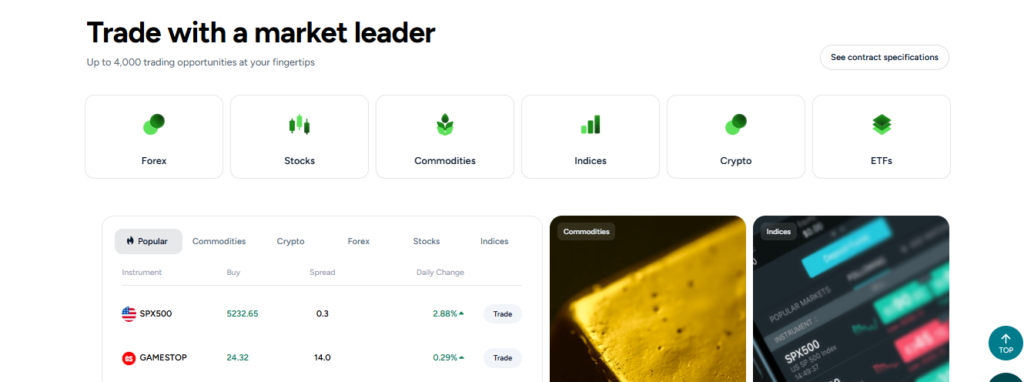

Besides lots of currency pairs, ThinkMarkets also offers some instruments you would like to trade on, such as Forex, Gold & silver, Stock CFD, Indexes, Crypto and Oil for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

ThinkMarkets supports trading on a wide range of assets, including:

- 3,500+ Share CFDs

- 17 index CFDs plus 6 which are priced in the Australian Dollar

- 46 currency pairs

- 11 commodity CFDs

- 27 cryptocurrency CFDs

- 11 futures contracts

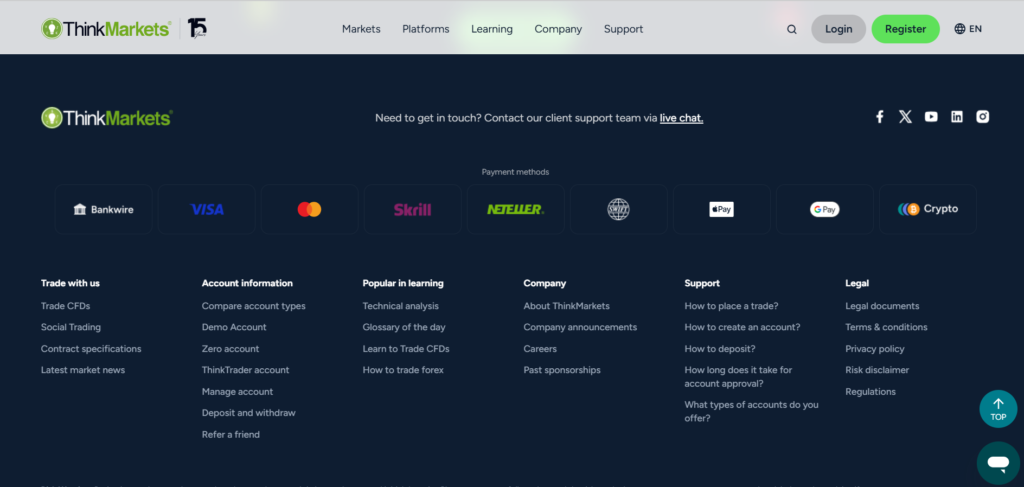

Payment Methods

Withdrawal and funding your account are possible through bank wires, credit/debit cards, Skrill, Neteller, and BitPay. Deposits are processed from instant to three business days, while withdrawal requests are processed within 24 hours. There are no fees for deposits or withdrawals, but third-party costs may apply. Bank wires face a $25 fee and require a minimum withdrawal of $100. ThinkMarkets may refuse a request on trading accounts with minimal trading activity, or if the withdrawal risks a negative account balance. However, it should be noted that if you are from the Asian region, payment using PayPal is currently not available.

Existing users can deposit money into their accounts through:

Wire transfer : Wire Transfer is the most commonly used payment method. Nearly all brokers in the world provide this method on their service. The reason is wire transfer is basically traditional transfer between banks in the worldwide. So, this method is guaranteed for its safety. This really helps traders who avoid third-party payments or don’t have credit cards.

Skrill : Mostly, all forex brokers provide Skrill as an online payment service option. Fast, easy, and safe transactions are the main reasons why traders using this method. Traders can use Skrill to fund their trading accounts with either payment cards, bank wire transfers, or directly from a Skrill e-wallet account.

PayPal : Online payment was not a thing back in the early 2000s, but PayPal has been in the market since 1999 and thus deserves to be regarded as one of the first e-payment services in the world. The US-based company is popular across many online platforms, including forex brokers.

Neteller : Like PayPal, Neteller is one of the most popular online payment services today. Due to this popularity, nearly all forex brokers accept Neteller as a payment method for their clients’ fund deposit and withdrawal. Although the Neteller system is available almost all over the world, it remains particularly popular in Europe.

ThinkMarkets also provides payment with Crypto, Tether (USDT), Perfect money, Ethereum, Credit/debit cards and BPAY.

Trading Platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, a price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitability by placing well-planned trades.

Hereby, ThinkMarkets offers you MetaTrader 4, MetaTrader 5, ThinkTrader, Social trading and Web.

- MT4: MT4 receives good customer reviews, promising reliability, and excellent infrastructure with over 20,000 expert advisors (EAs) and custom indicators, many free of charge.

- MT5: The more advanced MetaTrader 5 (MT5) platform offers a host of advanced tools suitable for professional and beginner traders.

- ThinkTrader: ThinkTrader is an alternative for manual trading, which features a clean user interface and real-time news from FX Wire Pro. Unfortunately, ThinkZero users cannot use this platform.

Unique Features

Head below for more details:

- Trading Central Indicator improves competitive trading tools and improves research and trading conditions.

- For automatic traders, there is free VPS hosting provided that they have traded 15.0 lots per month. Automatically, merchants who do not meet the criteria will be charged an additional fee even though there is a 15% discount offer.

- Social trading can be done through ZuluTrade.

- ThinkInvest provides in-house retail financial management services.

- The FIX protocol enables external trading solutions to connect to the ThinkMarkets infrastructure.

- The ThinkTrader platform has web-based, desktop and mobile versions.

2024 has been a remarkable year for ThinkMarkets, marked by significant updates and enhancements. Among the key highlights is the launch of a new Partner Portal, featuring a modern design, streamlined onboarding, and advanced performance tracking tools.

Additionally, ThinkMarkets introduced automated invoicing, eliminating the need for manual requests through the dashboard. The cashback services were also upgraded, ensuring payments were processed immediately after the corresponding invoice was finalized. These improvements reflect ThinkMarkets’ commitment to providing a seamless and efficient experience for its partners and clients.

Research and Education

There are several guides, news, and educational content available:

- Four in-house analysts who write high-quality market commentary and trading ideas under the Market News section. Readers can filter the information based on markets, categories, and authors. It also includes a market sentiment indicator based on client positions.

- The ten trading guides, split into three sections, deliver the best value and are an excellent starting point for new traders. A sign-up is mandatory to download the guides.

- The MT4 tips and tricks article is a helpful shortcut for new traders.

- Introduction to technical analysis, complemented by the indicators and chart patterns section.

- ThinkMarkets also hosts extensive live webinars.

Customer Support

Do you have any question or find any trouble related to ThinkMarkets? If you do, you should reach ThinkMarkets’s support to get the information that you need. Here is the detail of the broker’s customer support:

Traders can speak to customer support 24/7 via e-mail, call, or use the live chat function, the most convenient form to reach a support representative. The website also has a fairly extensive FAQ section that answers the most common questions. Most traders will not require assistance, but if the need arises, swift access is available.