- Variety of Trading Platforms

- Low Minimum Deposit

- High Leverage

- Rebates and Cashback

- No Fee on Deposits

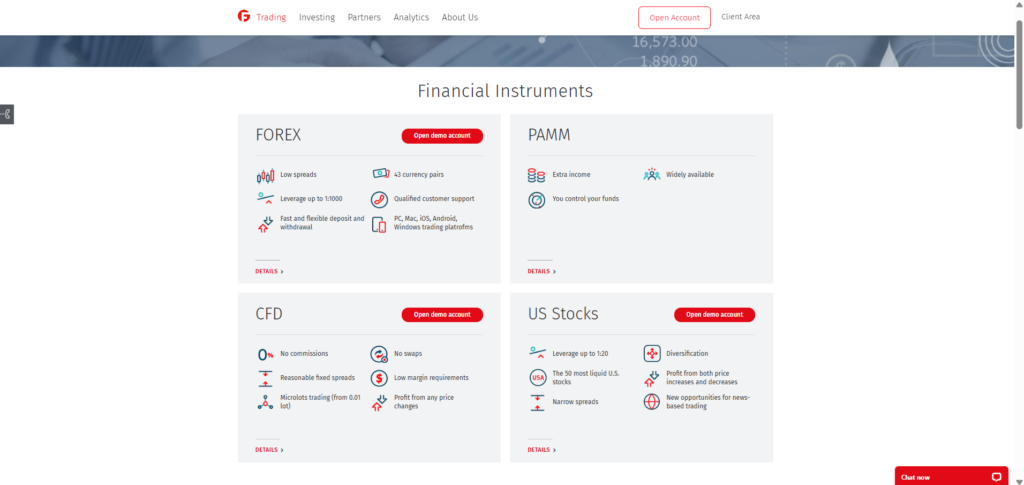

- Wide Range of Assets

- Limited Educational Resources

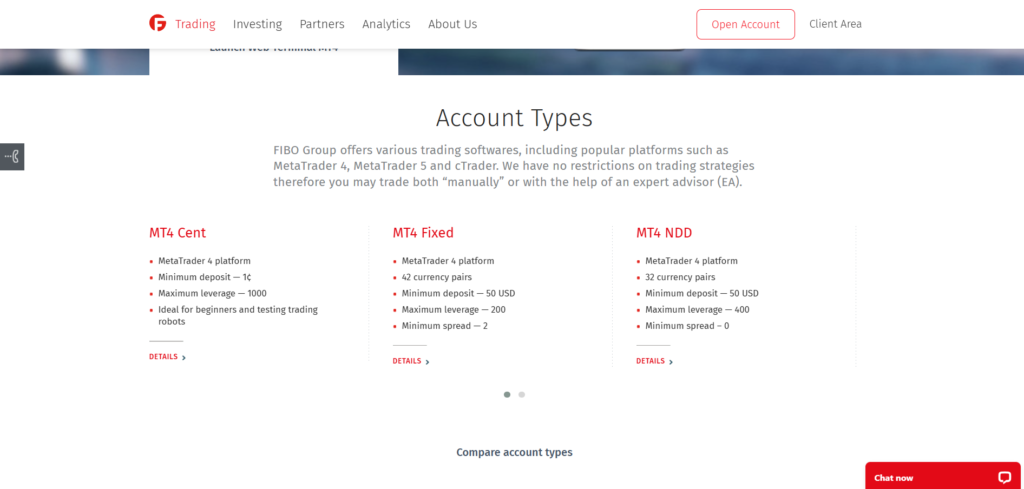

- Complex Account Types

- Limited Regulation

- High Leverage Risks

- Withdrawal Fees

Overview

FIBOGroup is a well-established broker since 1998. FIBOGroup has headquarters in Cyprus and British Virgin Islands. FIBOGroup to provide their Forex/CFD trading services to global clients.

This broker has also been regulated by CySEC 118/10 and FSC (BVI) SIBA/L/14/1063.

Founded in 1998, FIBO (Financial Internet Brokerage Online) Group is a Forex and CFD broker headquartered in the United Kingdom and regulated by CySEC. FIBOGroup is one of the oldest players in marginal internet trading as it provides a trading platform that offers a wide range of assets such as spot metals, indices, ETFs and individual stocks, and Forex currency pairs on major and minor financial markets.

Account Information

Apart from the forex demo account, this broker offers MT4 Cent, cTrader STP, MT4 Floating, MT4 Fixed, MT4 NDD No Commission, MT4 NDD and MT5 NDD. To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by FIBOGroup is up to 1: 1000 Meanwhile, you can open an account with a starting capital of $1.

Clients can choose between 7 account types:

- MT4 Fixed: MT4 Fixed account requires a minimum deposit of $50 and 0.01 lots minimum trade. All options come with fixed spread, scalping/hedging capabilities, Expert Advisors, trailing stop, pending orders, one-click trading, mobile trading, as well as automated trading. Swaps, or rollover rates, are charged on positions held overnight.

- MT4 Floating: The minimum deposit required is $300 with a minimum position size of 0.01 lots. MT4 Floating is a variable based which supports scalping, hedging, and Expert Advisors. Further features are trailing stop, pending orders, one-click trading, mobile trading, and automated trading. This account also charges swap rates.

- MT4 NDD: With variable spreads option, FIBOGroup traders can open an MT4 NDD account after deposit $50 and minimum trade sizes of 0.01 lots. The account boasts Expert Advisors, hedging opportunities, trailing stop, pending orders, one-click trading, mobile trading, and automated trading. However, it also charges overnight swap fees.

- cTrader STP: The minimum deposit at cTrader STP is $300. The minimum transaction size is 0.01 lots. Spreads are variable. The account offers hedging capability, trailing stop, pending orders, one-click trading, browser-based platform, and trading with API. However, swap rates for positions held overnight apply.

- MT4 Cent: A $1 minimum deposit applies with 0.01 lots minimum order size. Spreads are variable. Key features of MT4 cent are Expert Advisors, scalping opportunity, trailing stop, pending orders, one-click trading, mobile trading, and automated trading.

- MT5 NDD: MT5 NDD minimum deposit requirements are at $500 and a minimum trade size of 0.01 lots. Spreads are variable. Clients can benefit from a range of additional tools such as trailing stop, pending orders, one-click trading, mobile trading, and automated trading.

- MT4 NDD No Commission: Minimum deposit is $50 and a minimum trade size of 0.01 lots. Spreads are variable. MT4 NDD No Commission allows hedging. Traders can also attach a trailing stop, pending orders, as well as using one-click trading, mobile trading, and automated trading.

Fees

Spreads on major currencies are also reasonable, starting from 0.3 pips for EUR/USD and 1 point for major indices, including NASDAQ. The gold spread is around 0.5 USD and crude oil is 8 cents.

Commissions start at 0.003% from the amount of the transaction. FIBOGroup also $5 inactivity fee for accounts that lie dormant for 91 days or more. In addition, they also charge clients swap fees for holding positions open overnight.

Instruments Traded

Besides lots of currency pairs, FIBOGroup also offers some instruments you would like to trade on, such as Forex and CFD for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

There are 5 key markets available at FIBOGroup:

- 48 currency pairs

- spot metals

- over 20 CFDs on major indices and commodities

- 9 CFDs on cryptocurrencies

- range of shares.

Payment Methods

The process of funding funds into a FIBOGroup account is easy and safe because it can be done using various methods, including credit card, Skrill, CashU, WebMoney, Neteller, and wire transfer. Withdrawals can be made via Neteller, Skrill, Webmoney, wire transfer. Please note that the methods above vary depending on your jurisdiction.

There may be some deposit commissions, for example, bank transfers cost between $35-50, though most other deposit methods are commission-free. Withdrawal commissions start from 0.5%.

All methods have various processing times, from within a few minutes for some e-payment systems, up to a few days for bank transfers and some credit card payment systems.

Payments can be made via the following methods:

WebMoney : WebMoney is one of the major online wallet services which many people use to send money around the world. For this reason, there is a large number of forex brokers that accept WebMoney today. Like other online payment services today, WebMoney is supported by mobile applications to make transactions more efficient.

Wire transfer : Wire Transfer is the most commonly used payment method. Nearly all brokers in the world provide this method on their service. The reason is wire transfer is basically traditional transfer between banks in the worldwide. So, this method is guaranteed for its safety. This really helps traders who avoid third-party payments or don’t have credit cards.

Skrill : Mostly, all forex brokers provide Skrill as an online payment service option. Fast, easy, and safe transactions are the main reasons why traders using this method. Traders can use Skrill to fund their trading accounts with either payment cards, bank wire transfers, or directly from a Skrill e-wallet account.

Neteller : Like PayPal, Neteller is one of the most popular online payment services today. Due to this popularity, nearly all forex brokers accept Neteller as a payment method for their clients’ fund deposit and withdrawal. Although the Neteller system is available almost all over the world, it remains particularly popular in Europe.

FasaPay : Known as an e-payment for retail forex traders, FasaPay does not require a huge amount of fee, giving it a competitive edge among any other e-payments in the forex brokerage industry. Instant process is also featured as one of its advantages.

FIBOGroup also provides payment with Tether (USDT), Ripple, Perfect Money, Local bank transfer, Ethereum, Crypto, Credit/debit cards and Bitcoin Cash.

Trading Platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, a price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitability by placing well-planned trades.

Hereby, FIBOGroup offers you MetaTrader 4 (Limited with 60 days of inactivity), MetaTrader 5 (Limited with 60 days of inactivity) and cTrader (Limited with 60 days of inactivity).

- MT4: The MT4 trading platform is the top choice for traders of all levels of experience. The software offers a customizable interface and supports various trading styles. Through MT4, traders can analyze the market at 9 different time intervals, using 30 indicators and various graphical objects. There is also a trading history feed as well as real-time quotes on Market Watch.

- MT5: MT5 is the successor to MT4 which comes with several differences, including the addition of an economic calendar and Depth of Market liquidity. There are also more complete technical indicators and drawing tools, plus 21-time intervals and advanced order and execution types.

- cTrader: cTrader platform is suitable for both professional and novice traders. The platform offers one-click trading, market sentiment indicators, economic news, Market Depth view, and cAlgo integrated trading robot. There are also more than 50 indicators and 26 chart time frames to choose from along with a copytrading function.

Unique Features

FIBOGroup has a wealth of additional tools designed to improve your trading experience and output:

- The market-maker type account can be opened with either fixed or variable spread regimes.

- PAMM System

- Dedicated Automated Trading services, including signals provision.

- Asset Management

Research and Education

FIBO Group offers some additional research and education materials including:

- YouTube videos on forex basics.

- Up-to-date market analysis is provided on current market conditions and events which are dominant fundamental and sentimental factors.

- The section on Long-Term Forecasts, which at the time of this review was empty.

- A competent calendar of events likely to influence markets is included for easy time-based reference.

- Free charting tool with live instrument prices is also placed within the Analytics section.

- Table of current interest rates in the more important global economies is included, which can be useful in fundamental analysis.

Bonuses and Promotions

At the time of writing, FIBOGroup offers RDO-5% bonus promotion from the 15th of October 2021 through the 31st of December 2021 for clients of FIBO Group, Ltd (BVI) who opened and activated an MT4 NDD account in the RDO base currency in the promotion’s duration period. New FIBO Group clients and those who have already signed up can both participate in the promotion.

Customer Support

Do you have any question or find any trouble related to FIBOGroup? If you do, you should reach FIBOGroup’s support to get the information that you need. Here is the detail of the broker’s customer support:

FIBOGroup runs the customer support team from Cyprus, who can be contacted using a telephone (+44 [845] 09-50-118), email ([email protected]), or live chat. Besides Cyprus, there are dedicated lines and email addresses listed on the FIBO Group’s website allowing communication with their offices in Shanghai, Singapore, and Limassol. Alternatively, you can also try one of the global representative offices in Kazakhstan, Germany, or China.