Pepperstone is a well-established broker since 2010. Pepperstone has headquarters in Australia, Germany, Kenya, Cyprus, United Arab Emirates, United Kingdom and Bahamas. Pepperstone to provide their Forex/CFD trading services to global clients.

This broker has also been regulated by ASIC 414530, BaFin 151148, Capital Markets Authority of Kenya 128, CySEC 388/20, DFSA (Dubai) F004356, FCA 684312 and SCB SIA-F217.

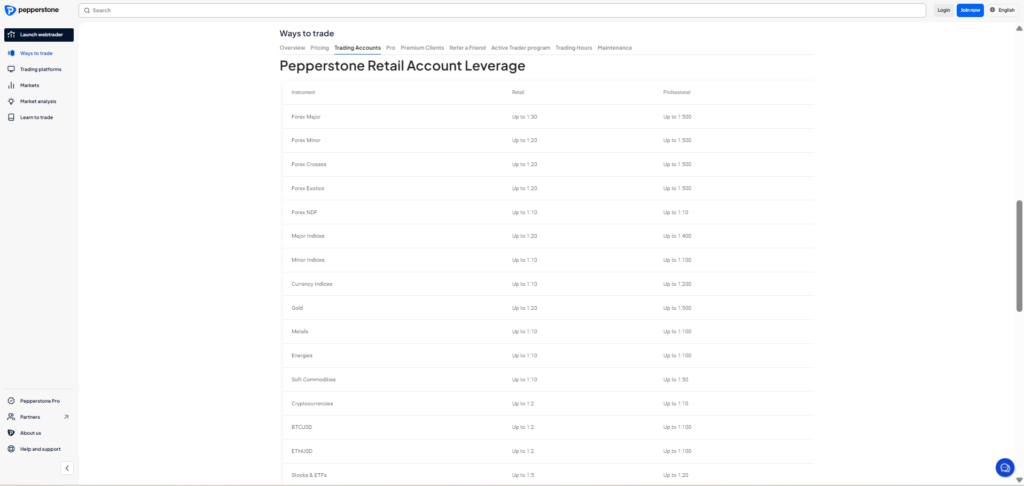

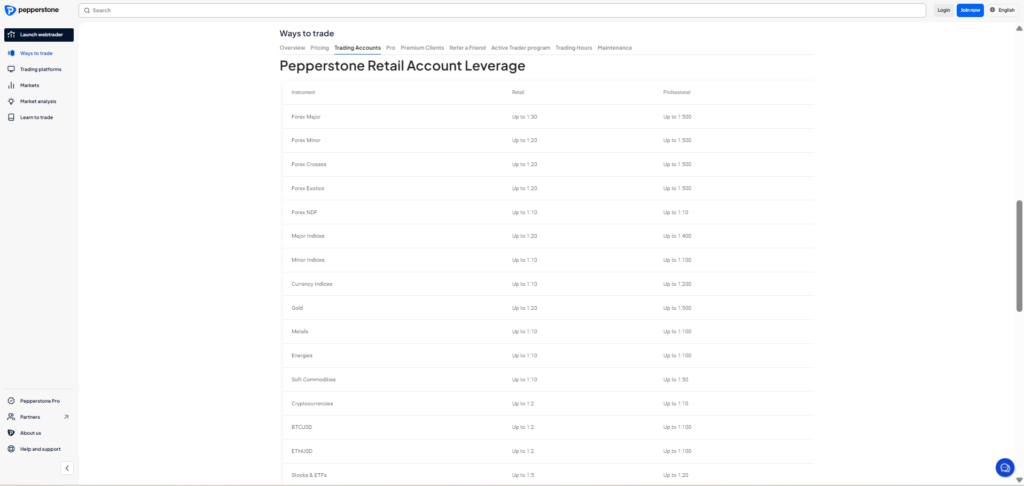

Pepperstone’s seven well-regulated subsidiaries will limit the potential for fraud and malpractice. Pepperstone clients may enjoy features such as negative balance protection while deposits remain segregated from corporate funds. Pepperstone members can utilize leveraged trading depends on subsidiaries:

- The Kenyan subsidiary offers negative balance protection plus maximum leverage of 1:400.

- Traders at the Bahamas unit get 1:200 without negative balance protection.

- Pepperstone Australia offers maximum leverage of 1:30, negative balance protection, but no compensation scheme for depositors.

- Pepperstone UK offers maximum leverage of 1:30, negative balance protection, and the best regulatory mandated compensation scheme of £85,000 per client.

- In CySEC, FSCA, and BAFIN licensed subsidiaries, Pepperstone offers maximum leverage of 1:30 for retail traders and 1:500 for professional.

Pepperstone Summary

| 🏢 Headquarters | Australia |

| 📆 Established | 2010 |

| 🗺️ Regulation | FCA, ASIC, CySEC, SCB, DFSA, BaFin and CMA |

| 🖥 Platforms | MT4, MT5, TradingView, cTrader |

| 📉 Instruments | Forex, indices, shares, metals, cryptocurrencies and commodities |

| 💳 Minimum Deposit | $200 |

| 💰 Deposit Methods | Mastercard, Visa, Bank transfer, PayPal, Skrill, Union Pay, Neteller, POLi, BPay, and more. |

| 📱 Mobile Trading | Yes |

| 🌍 Web Trading | Yes |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | Up to 1:500 |

| 🌍 Copy Trading | Available |

| 🤖 Robots | Yes |

| 🎯 Scalping | Yes |

| ☎ Customer Support | 24/7 |

Account Information

Apart from the forex demo account, this broker offers Razor and Standard. To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by Pepperstone is up to 1: 400 Meanwhile, you can open an account with a starting capital of $0.

There are 2 account types that can be created during registration:

- Standard: Standard has minimum deposits of $200. The minimum lot size is 0.01. The account would be a good option for variable spreads that allow scalping, hedging, and Expert Advisors. It also supports trailing stop, pending orders, one-click trading, mobile trading, and automated trading. A swap rate will also apply to overnight positions.

- Razor: A minimum deposit amount of $200 and the minimum trading volume of 0.01 lot apply. Spreads are variable at Razor account and complemented by Expert Advisors, scalping, as well as hedging capabilities. Pending orders, trailing stop, one-click trading, mobile trading, and automated trading are available. Other charges include overnight swap fees.

Fees

Spreads are generally competitive, for example, the spread on EUR/USD during the London-New York session is 0 pips plus a commission of $7 with the Active Trader Program. This is the same as a spread of 0.7 pips. Their equity CFDs commission rates are also notably low with 0.07%, averaging at 0.10%. There are some other costs to be aware of. For example, an inactivity fee is charged to accounts that have been dormant for ten trading days. Also, swap rates are charged to clients that hold positions overnight.

Instruments Traded

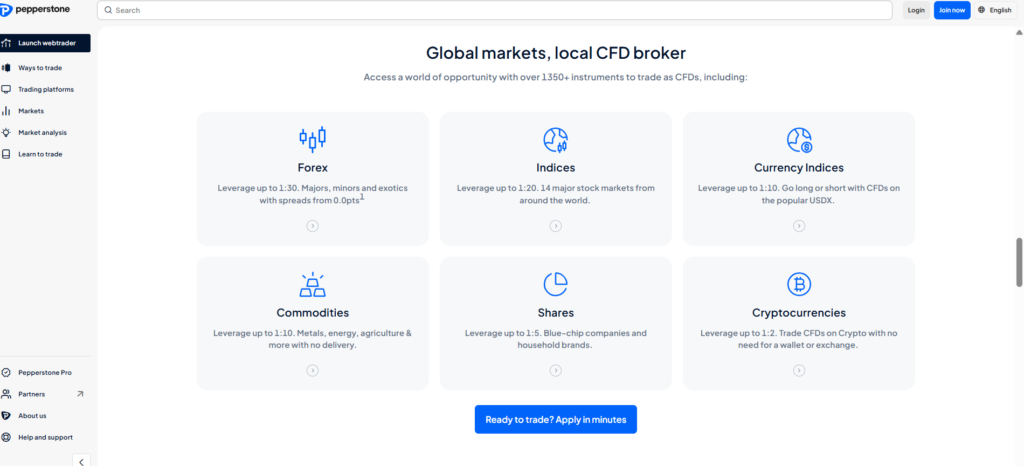

Besides lots of currency pair, Pepperstone also offers some instruments you would like to trade on, such as Forex, Gold & silver, Crypto, Stocks, CFD, Indexes, Oil, Metals, Energies, Soft Commodities, Agriculture, Spread Betting (only for UK clients) and ETF for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Pepperstone offers CFD trading in forex, commodities, stocks, and cryptocurrencies (depending on the region):

- 62 currency Pairs

- 18 cryptocurrency Pairs

- 3 cryptocurrency indices

- 23 commodities and metals

- 29 index CFDs

- 940+ equity CFDs

- 100+ ETFs

Payment Methods

There’s a decent range of payment options at Pepperstone, with only cryptocurrencies missing. All payment methods are free, except for bank wires outside Europe and Australia which charge $20. Note, there are third-party payment processor costs that clients need to pay.

Several payment methods are available:

Wire transfer : Wire Transfer is the most commonly used payment method. Nearly all brokers in the world provide this method on their service. The reason is wire transfer is basically traditional transfer between banks in the worldwide. So, this method is guaranteed for its safety. This really helps traders who avoid third-party payments or don’t have credit cards.

Skrill : Mostly, all forex brokers provide Skrill as an online payment service option. Fast, easy, and safe transactions are the main reasons why traders using this method. Traders can use Skrill to fund their trading accounts with either payment cards, bank wire transfers, or directly from a Skrill e-wallet account.

PayPal : Online payment was not a thing back in the early 2000s, but PayPal has been in the market since 1999 and thus deserves to be regarded as one of the first e-payment services in the world. The US-based company is popular across many online platforms, including forex brokers.

Neteller : Like PayPal, Neteller is one of the most popular online payment services today. Due to this popularity, nearly all forex brokers accept Neteller as a payment method for their clients’ fund deposit and withdrawal. Although the Neteller system is available almost all over the world, it remains particularly popular in Europe.

Pepperstone also provides payment with Credit/debit cards and UnionPay.

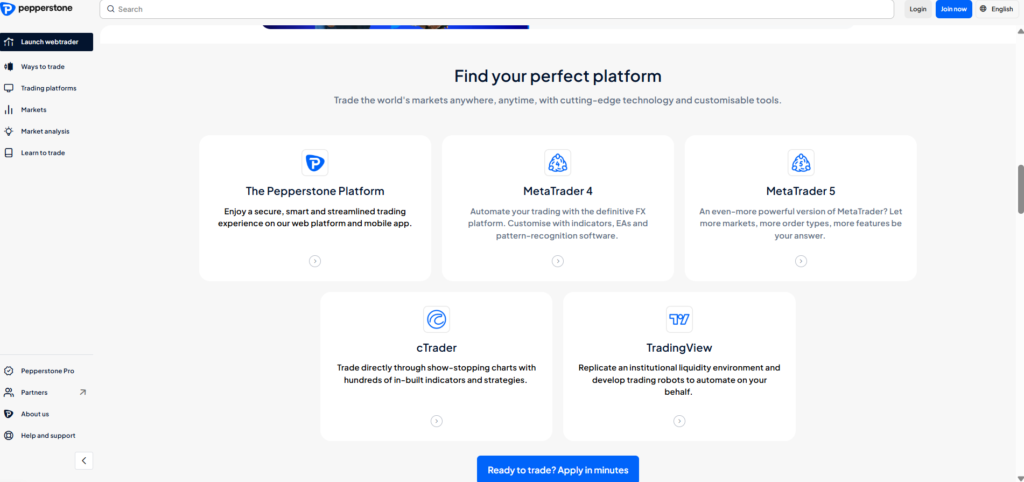

Trading Platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, a price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitability by placing well-planned trades.

Hereby, Pepperstone offers you MetaTrader 4, MetaTrader 5, cTrader, TradingView, Social trading and Web.

- MT4: Highlights of MT4 include 28 plug-ins Smart Trader suite, Autochartist, VPS hosting, support algorithmic trading, and copy trading functions. Pepperstone also provides social trading via third-party providers Myfxbook, MetaTrader Signals, and DupliTrade.

- MT5: MetaTrader 5 provides exceptional features to help you stay ahead of the markets as it is easier to use, easier to code using MQL5, provides advanced platform customization, offers 38 inbuilt indicators, Smart Trader Tools, Autochartist, and the ability to hed your position.

- cTrader: Created by Spotware with the mission to balance simple and complex functionality, cTrader is excellent for both new and advanced traders. Traders can place advanced order types and better understand the orders they’re placing in more detail.

Unique Features

There are some useful trading services available, one of which is API trading. However, traders must accumulate $250 million in monthly trading volume or approximately 2,500 lots to enjoy this facility. If you have advanced trading solutions that require API trading, this amount might not be a problem for you.

Research and Education

Pepperstone has an extensive range of research material including high-quality written market commentary, trade ideas, and videos, presented with tradeable information and well-explained. Pepperstone offers a modest range of education resources for beginner traders with an in-depth collection of articles, supplemented by webinars and two trading courses.

Bonuses and Promotions

Pepperstone does not offer any deposit bonuses at this time, even though there is an Active Trader Program to reward high-volume traders. Depending on the regulatory jurisdiction, you may find refer-a-friend promotions with referrals that must be fulfilled within 90 days.

Customer Support

Do you have any question or find any trouble related to Pepperstone? If you do, you should reach Pepperstone’s support to get the information that you need. Here is the detail of the broker’s customer support:

Pepperstone’s support team operates 24/5, where the live chat function from the back office offers the most convenient contact method. Clients can also contact the customer support team via e-mail and a phone number.

-

- .