- Variety of Trading Platforms

- Low Minimum Deposit

- High Leverage

- Rebates and Cashback

- No Fee on Deposits

- Wide Range of Assets

- Limited Educational Resources

- Complex Account Types

- Limited Regulation

- High Leverage Risks

- Withdrawal Fees

FxPro is a well-established broker since 2006. FxPro has headquarters in United Kingdom, Cyprus, South Africa and United Arab Emirates. FxPro to provide their Forex/CFD trading services to global clients.

This broker has also been regulated by FCA 509956, CySEC 078/07, FSCA 45052, DFSA (Dubai) F003333 and FSC (Mauritius).

In its over 22-year history, FxPro has established itself as a trusted name in the industry, having executed hundreds of millions of orders with precision. With a company capital of €100,000,000 and a Tier 1 rating, FxPro boasts a solid financial foundation.

Offering four trading platforms and over 2,100 financial instruments, FxPro ensures a diverse range of options for traders.

With an average execution time of less than 13 milliseconds and the capability to execute up to 7,000 orders per second, FxPro provides ultra-fast execution, supported by low-latency data centre co-location.

FxPro Summary

| 🏢 Headquarters | UK |

| 📆 Established | 2006 |

| 🗺️ Regulation | FCA, CySEC, FSCA and SCB |

| 🖥 Platforms | MT4, MT5, cTrader, FxPro Edge |

| 📉 Instruments | Forex and CFDs on 6 asset classes, with over than 260 instruments |

| 💳 Minimum Deposit | $100 |

| 💰 Deposit Methods | Debit, credit, and prepaid cards (Visa, Mastercard), Bank wire transfer, Paypal |

| 📱 Mobile Trading | Available |

| 🌍 Web Trading | Available |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | 1: 500 |

| 🌍 ECN | Available |

| 🤖 Robots | Available |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/5 |

Account Information

Apart from the forex demo account, this broker offers Standard Account, Elite and Raw+. To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by FxPro is up to 1: 10000 Meanwhile, you can open an account with a starting capital of $100.

Standard Account

The Standard Account requires an initial deposit of $100 and offers Pro-Powered leverage. For FX trading, spreads for major currency pairs like EURUSD, GBPUSD, and USDJPY start from 1.2 pips, with an average spread of 1.5 pips.

When trading Gold, spreads start from 25 cents, with an average spread of 30 cents. Similarly, for Bitcoin trading, spreads start from $30, with an average spread of $40. The trade size starts from 0.01, and the margin call/stop out levels are set at 25%/20%.

The Standard Account could be suitable for beginners, given its relatively low initial deposit requirement and the availability of Pro-Powered leverage. However, beginners should carefully consider the charges and costs associated with trading, such as spreads.

Raw+

The Raw+ account requires an initial deposit of $500 and provides Pro-Powered leverage. For FX trading, charges are $3.5 per side in addition to raw spreads, which start from 0 pips for major currency pairs like EURUSD, GBPUSD, and USDJPY, with an average spread of 0.2 pips. When trading Gold, charges are $3.5 per side plus raw spreads starting from 10 cents, with an average spread of 15 cents.

Similarly, for Bitcoin trading, charges are $3.5 per side plus spreads starting from $15, with an average spread of $20. The trade size starts from 0.01, and the margin call/stop out levels are set at 25%/20%. The platform available for trading is MT4/MT5.

The Raw+ account is best suited for experienced and advanced traders who are comfortable with higher initial deposit requirements and are seeking access to raw spreads with the added benefit of Pro-Powered leverage.

Given the charges of $3.5 per side in addition to the raw spreads, this account is more suitable for traders with a solid understanding of trading costs and who engage in frequent trading activity.

Elite

The Elite account, requiring an initial deposit of $30,000 within 2 months, offers Pro-Powered leverage for traders seeking advanced features and capabilities.

For FX trading, charges are $3.5 per side. Like Raw+ account, in Elite, you can also enjoy the promotion of raw spreads, which start from 0 pips for major currency pairs like EURUSD, GBPUSD, and USDJPY, with an average spread of 0.2 pips. When trading Gold, charges are $3.5 per side plus raw spreads starting from 10 cents, with an average spread of 15 cents.

Similarly, for Bitcoin trading, charges are $3.5 per side plus spreads starting from $15, with an average spread of $20. Rebates start from $1.5 per lot, trade size starts from 0.01, and margin call/stop out levels are set at 25%/20%.

The Elite account is tailored for experienced and high-net-worth traders who are looking for advanced features and capabilities in their This account is designed for traders who have a substantial capital base and are seeking access to Pro-Powered leverage.

Instruments Traded

Besides lots of currency pairs, FxPro also offers some instruments you would like to trade on, such as Forex, Futures, Indexes, Metals, Energies, Crypto and Indices for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Payment Methods

PayPal : Online payment was not a thing back in the early 2000s, but PayPal has been in the market since 1999 and thus deserves to be regarded as one of the first e-payment services in the world. The US-based company is popular across many online platforms, including forex brokers.

Wire transfer : Wire Transfer is the most commonly used payment method. Nearly all brokers in the world provide this method on their service. The reason is wire transfer is basically traditional transfer between banks in the worldwide. So, this method is guaranteed for its safety. This really helps traders who avoid third-party payments or don’t have credit cards.

Skrill : Mostly, all forex brokers provide Skrill as an online payment service option. Fast, easy, and safe transactions are the main reasons why traders using this method. Traders can use Skrill to fund their trading accounts with either payment cards, bank wire transfers, or directly from a Skrill e-wallet account.

Neteller : Like PayPal, Neteller is one of the most popular online payment services today. Due to this popularity, nearly all forex brokers accept Neteller as a payment method for their clients’ fund deposit and withdrawal. Although the Neteller system is available almost all over the world, it remains particularly popular in Europe.

FxPro also provides payment with UnionPay, Tether (USDT), Ethereum, Crypto and Credit/debit cards.

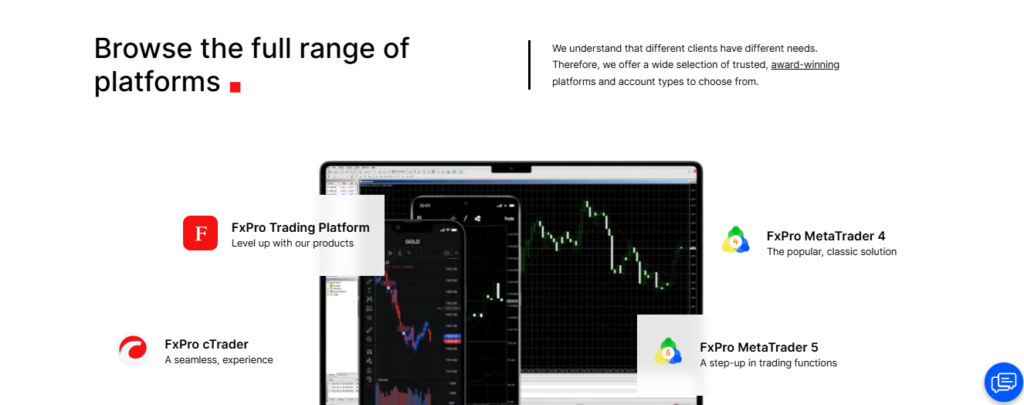

Trading Platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, a price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitability by placing well-planned trades.

Hereby, FxPro offers you MetaTrader 4, MetaTrader 5, FxPro Platform and cTrader.

- MT4: Forget clunky interfaces – MetaTrader 4 (MT4) is the go-to platform for serious forex traders. It’s packed with features to chart, analyze, and trade currencies. Plus, FxPro pairs their MT4 with top-notch infrastructure, and competitive pricing, and lets you execute orders directly, without any shady middleman. This combo makes FxPro’s MT4 a force to be reckoned with in the world of online forex trading.

- MT5: If you loved FxPro’s MT4 platform, you’ll adore the MT5. It builds on the strengths of its predecessor, offering everything you need to conquer the financial markets. This user-friendly platform lets you customize it to match your trading style. Plus, power users will love the advanced features for building their trading robots (Expert Advisors) and exploring new tools. FxPro’s MT5 is a clear winner for traders who crave flexibility and control.

- FxPro Platform: FxPro offers a powerful platform that lets you trade and manage your account seamlessly. The FxPro app keeps everything in one place: manage accounts, funds, and trades – all on your mobile device for ultimate convenience. Prefer a desktop experience? The web platform provides easy access to your FxPro EDGE Accounts directly from your browser. Plus, you can customize the interface and use advanced trading widgets to tailor your trading experience. FxPro caters to both on-the-go traders and those who prefer a traditional setup.

- cTrader: FxPro just slashed its commissions to a record-low $35 per $1 million traded on cTrader. That means you can enjoy even tighter spreads on currencies and metals. This combination makes FxPro’s cTrader platform a game-changer for cost-conscious forex traders seeking an innovative trading experience.

Customer Support

Do you have any question or find any trouble related to FxPro? If you do, you should reach FxPro’s support to get the information that you need.