- The availability of credit/debit card options

- No deposit fees

- Multiple account base currencies

- Regulated in both tier-1 and tier-2 jurisdictions

- Low average spreads across all types of accounts

- Access to third-party research and trading tools

- Extensive range of markets

- Some restrictions may apply to withdrawals

- IC Markets does not have a proprietary trading app

- High minimum deposit required to open an account

- Limited market analysis

- The availability of in-depth market analysis may be more limited

IC Markets is a well-established broker since 2007. IC Markets has headquarters in Australia, Cyprus, Bahamas, China, European area, Hong Kong, India, Indonesia, Spain, Thailand, Turkey, United Arab Emirates, United Kingdom and Nigeria. IC Markets to provide their Forex/CFD trading services to global clients.

This broker has also been regulated by ASIC ACN 123 289 109, CySEC 362/18, SCB SIA-F214, The Financial Commission 25112021 and FSA (Seychelles).

We can say that IC Markets is a legitimate broker that is safe to trade with and not a scam with all those licenses. Especially for algorithmic traders or scalpers, IC Markets could be your first choice as it provides excellent trading costs, high leverage, low latency connectivity, and superior liquidity.

With a reputation for innovation, reliability, and competitive pricing, IC Markets has garnered a loyal customer base worldwide. Over the years, the broker has achieved several significant achievements:

IC Markets is a top pick for traders who rely on technology. Our super-fast trading engine, based in New York, handles a massive number of 500,000 trades every day – and a big chunk of those are from automated systems just like yours.

Three copy trading services are also available to facilitate social traders, while beginner traders benefit from a high-quality educational platform and 24/7 customer support. IC Markets offers negative balance protection and segregates client deposits from corporate funds.

IC Markets Summary

| 🏢 Headquarters | Australia |

| 📆 Established | 2007 |

| 🗺️ Regulation | ASIC, CySEC |

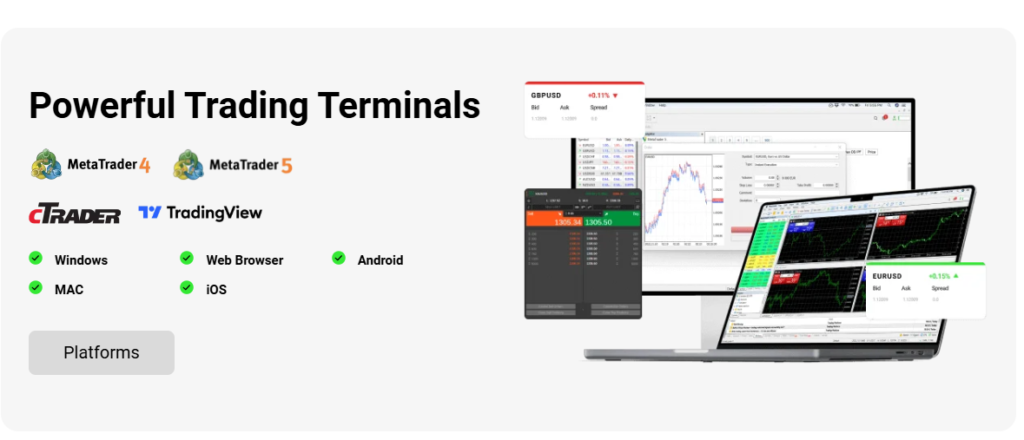

| 🖥 Platforms | cTrader, MT4, MT5 |

| 📉 Instruments | FX, Equities, Commodities, Futures CFDS, Stocks and Bonds, Crypto trade |

| 💳 Minimum Deposit | $200 |

| 💰 Deposit Methods | Wire Transfer, PayPal, Credit Card, Skrill, Neteller, UnionPay, FasaPay, and Poli. |

| 📱 Mobile Trading | Available |

| 🌍 Web Trading | Available |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | 1: 500 |

| 🌍 ECN | Available |

| 🤖 Robots | Available |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/5 |

Account Information

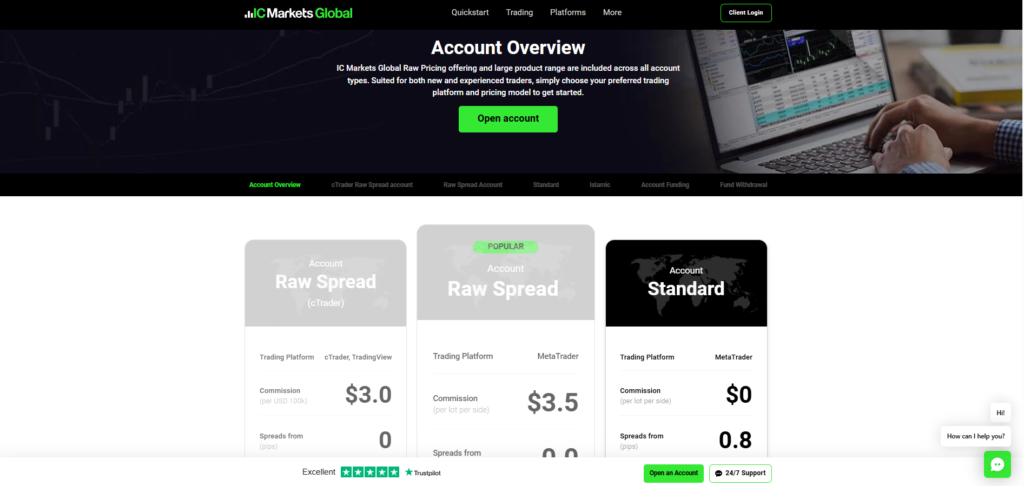

Apart from the forex demo account, this broker offers Raw Spread and Standard. To successfully navigate your trading account, you also need to consider about leverage and minimum deposit. Talking about leverage in general, the maximum leverage offered by IC Markets is up to 1: 1000 Meanwhile, you can open an account with a starting capital of $200.

IC Markets offers the following trading accounts:

- Standard: Standard account requires a minimum deposit of $200 and a minimum lot size of 0.01. To offer traders the best prices, this account type uses variable spread. Overall, the account is offering a multitude of tools, such as trailing stop, pending orders, one-click trading, browser-based platform, and trading via API. However, you don’t have the Expert Advisor nor scalping strategy options.

- Raw Spread: The minimum deposit is $200 and the minimum lot size is 0.01. Raw Spread promises straightforward market access via one-click trading, automated trading, and mobile trading with a variety of tools including trailing stop and pending orders. Expert Advisor and scalping are allowed.

Fees

Commissions at IC Markets vary by the trading platform. The commission is $6 per lot for cTrader and $7 per lot for MT4/MT5. The pricing difference lowers profit potential by 16.67% for MT4/MT5 traders.

Fees of 0.10% are charged for equity traders, except US-listed equities, where the cost is $0.02 per share per side. Other costs to be aware of include third-party payment processors and overnight swap rates. However, one of the advantages of using IC Markets is they do not charge an inactivity fee.

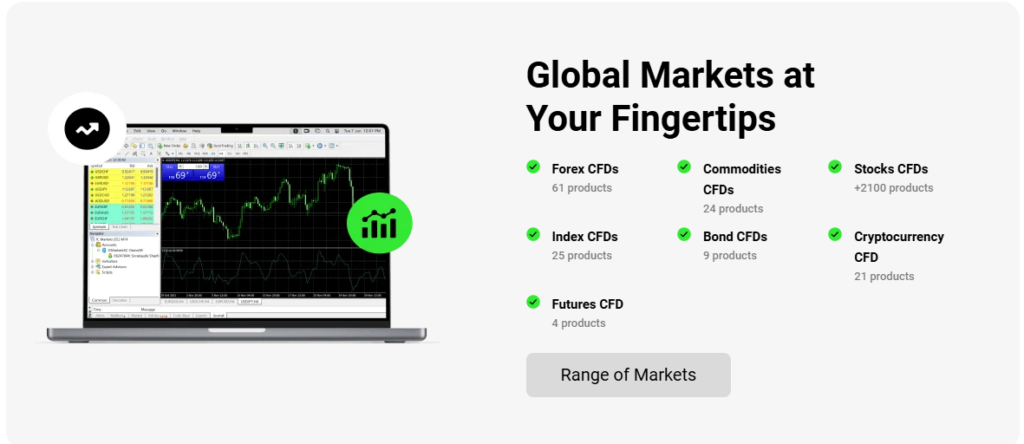

Instruments Traded

Besides lots of currency pairs, IC Markets also offers some instruments you would like to trade on, such as Forex, CFD, Bonds, Crypto, Commodities, Gold, Oil, Indices and Stock for your best choice. Somehow, remember that different instrument has different trading conditions. In this case, you have to make sure that your strategy is well suited for the instrument you chose.

Available trading markets on IC Markets include:

- 23 indices.

- 61 currency pairs.

- over 22 commodities.

- 1600+ stocks.

- More than 11 bonds.

- 13 cryptocurrency pairs.

- 4 futures CFDs.

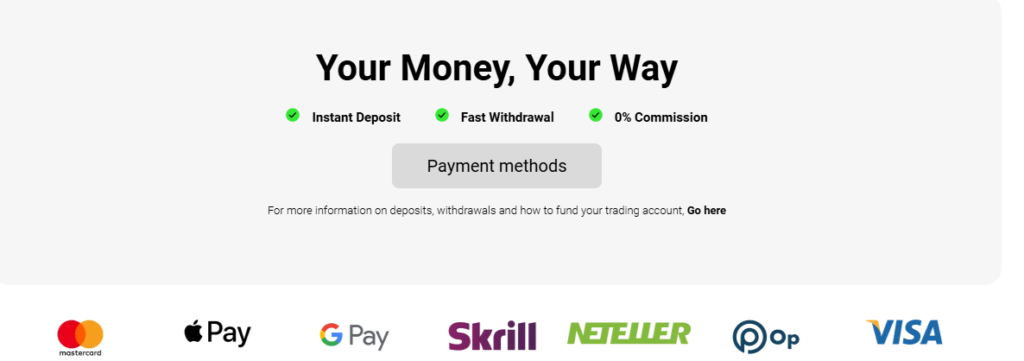

Payment Methods

IC Markets offers their clients a variety of deposit and withdrawal options, with only cryptocurrencies missing. Although there are no internal costs, all bank wire transfers are charged a fee of $20 with third-party payment processor costs applied. Withdrawals are processed within the same day as long as received before noon AEST/AEDT.

Both funding and withdrawal are available via many methods that you should check before determining which is the most efficient for you.

IC Markets also provides payment with Crypto, UnionPay, Credit/debit cards and BPAY

Trading Platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, a price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitability by placing well-planned trades.

Hereby, IC Markets offers you MetaTrader 4, MetaTrader 5, cTrader, webIRESS, ProDeal, Social Trading and ZuluTrade.

- MetaTrader 4: The MetaTrader 4 platform includes a broader range of technical indicators and orders, including one-click trading solutions, customizations for market depth analysis, advanced charting tools, Expert Advisers, and extensive back-testing options.

- MetaTrader 5: The MT5 platform offers an upgraded and expanded version of the MetaTrader 4 platform.

- cTrader: This trading platform is custom-made for an ECN trading environment. This includes automated trading software and is available on mobile desktops and the web. Traders who want to use auto-trading have three options to choose from; ZuluTrade, Myfxbook’s AutoTrade and Signal Trader’s mirroring technology.

Unique Features

Designed to provide an enhanced trading experience, IC Markets includes some unique features:

- MAM/PAMM solutions

- VPS servers with three providers can be obtained free of charge if the trader’s monthly trading volume exceeds 15 lots.

- Myfxbook Autotrade and ZuluTrade cater to the needs of social trading.

- The Advanced Trading Tools suite upgrades MT4 and into a competitive trading platform with features 20 exclusive trading tools.

Research and Education

One of the areas in which IC Markets is extremely strong is a blog that offers high-quality research and trading ideas. Users can select from six categories:

- Fundamental Analysis

- Technical Analysis

- WebTV by Trading Central

- Getting Started: educational platform with the video tutorials and then the 10-lessons

- Webinars: seven experts host them in English, Spanish, Chinese, Portuguese, and Thai.

- Podcasts: hosted by two presenters, add value and remain very popular among a younger generation of traders.

Customer Support

Do you have any question or find any trouble related to IC Markets? If you do, you should reach IC Markets’s support to get the information that you need. Here is the detail of the broker’s customer support:

- Access to multilingual support

- Live chat 24/7.

- Additional options include e-mail and toll-free numbers.

- The Help Center attempts to answer the most common questions.