- A diverse range of trading instruments

- Zero spread account ready

- Instant withdrawals

- High level of transparency

- High minimum deposit

- No education for newbies traders

- Not available for USA clients

Founded in 2008, Exness has grown into a reputable global broker with a strong international presence. The company maintains headquarters and operations across multiple regions including Seychelles, Saint Martin, the British Virgin Islands, South Africa, the United Kingdom, the European Economic Area, France, Nigeria, and Brazil, offering Forex and CFD trading services to a worldwide clientele.

Exness is regulated by several prominent financial authorities, including the FSA (Seychelles), CBCS (Curaçao), FSC (British Virgin Islands), FSCA (South Africa), CMA (Kenya), FCA (UK), CySEC (Cyprus), and ESMA (EU). These regulatory bodies ensure the broker adheres to strict financial and operational standards.

In October 2018, Exness made the strategic decision to cease its retail operations in the UK and Cyprus due to increased competition and other market factors. However, the company still operates in these regions by offering financial services exclusively to institutional clients and professional traders.

Currently, Exness provides retail trading services through its Nymstar Limited entity, based in Seychelles. The broker continues to expand, especially across developing markets in Asia, Europe, and Africa.

By December 2019, Exness had amassed a global user base of over 232,000 active traders, with a monthly trading volume surpassing $1 trillion—a testament to its growing popularity and trust among traders.

Exness is also recognized for its commitment to transparency. It regularly publishes financial reports audited by Deloitte, one of the Big Four accounting firms. While these reviews are not formal audits and do not follow International Standards on Auditing or Review Engagements, Deloitte does verify the existence and accuracy of client funds, perform fund reconciliation, and conduct other key financial assessments.

The broker offers a wide array of services, including support for 107+ currency pairs, a low minimum deposit of just $1, leverage up to 1:2000, and a competitive fee structure. Client fund safety is a top priority for Exness, ensured through segregated accounts and negative balance protection, safeguarding traders from market volatility.

Thanks to its robust regulatory framework, transparent operations, and client-focused offerings, Exness has earned its place among the leading global brokers in the forex industry.

Summary

| 🏢 Headquarters | Cyprus, UK and Seychelles |

| 📆 Established | 2008 |

| 🗺️ Regulation | CySEC, FCA, the Seychelles FSA, South Africa FSCA, the BVI Financial Services Commission and the Central Bank of Curaçao. |

| 🖥 Platforms | Exness MT4, MT5, Exness Terminal, Desktop, Web and Mobile (iOS, Android) |

| 📉 Instruments | Forex, Cryptocurrencies, Metals, Energies, Stocks and Indices |

| 💳 Minimum Deposit | $10 |

| 💰 Deposit Methods | Bitcoin, Bank Card, FasaPay, Skrill, Neteller, Perfect Money, Tether, Webmoney |

| 📱 Mobile Trading | Available |

| 🌍 Web Trading | Available |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | 1: Unlimited |

| 🌍 ECN | Available |

| 🤖 Robots | Available |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/5 in different languages |

Account Information

In addition to its forex demo account, Exness offers a variety of live account types to suit different trading needs, including Standard, Standard Cent, Raw Spread, Pro, and Zero accounts.

To effectively manage your trading experience, it’s important to understand key factors such as leverage and minimum deposit requirements. Exness provides maximum leverage of up to 1:2000, allowing traders to amplify their positions.

You can get started with a minimum deposit as low as $10, making it accessible for both beginners and experienced traders alike.

Exness account types vary in many aspects. Here are the details:

- Standard: With a minimum deposit of $1, this account is available with variable spreads and many types of trading features including one-click trading, expert advisors, and browser-based platforms.

- Raw Spread: Similar to its name, the account is provided for traders who want to try trading with raw spreads. But, it should be noted that the minimum deposit in this account starts from $200. If the amount of capital is not considered acceptable by your standard, it’s better to choose other types of accounts with smaller deposit requirements.

- Pro: Exness pro account is similar to the raw spread account in its starting capital requirement. But it’s clear that this account is tailored for professional traders who may need to trade without restrictions.

- Standard Cent: With a minimum deposit of $1, clients can trade with Cent base currency to minimize their risks. In addition, a number of trading features like mobile trading, automated trading, and one-click trading are available here. Hedging and scalping are also allowed in this account.

- Zero: Exness zero account is categorized under “Pro Accounts” with 0 spreads for 95% of the trading day on 30 pairs. It is not quite different from the raw spread account that requires a $200 minimum deposit, but it should be noted that zero account’s commission starts from $3.5 whereas raw spread’s account is only up to $3.5.

Trading Fees

Exness offers a flexible fee structure that varies across its five different account types, catering to both beginners and experienced traders. Each account comes with its own terms, conditions, commission rates, and pricing models.

For professional traders, the Pro account is often considered the most favorable. It features zero trading commissions and tight spreads, with EUR/USD starting from just 0.6 pips—making it an excellent choice for high-volume or experienced traders.

On the other hand, beginners may prefer the Standard account, which is more accessible with a minimum deposit of just $1 and maximum leverage of up to 1:2000. This account type offers a cost-effective way to build trading skills without a significant upfront investment.

Overall, Exness provides competitive and transparent trading fees across all account types. Whether you’re a novice or a seasoned trader, you can choose a plan that aligns with your strategy and trading volume.

Additionally, it’s worth noting that the previously applied $5 monthly inactivity fee was removed as of September 23, 2020, making the platform even more user-friendly. Exness also offers relatively low commissions for cryptocurrency trading, giving traders even more value across asset classes.

Instruments Traded

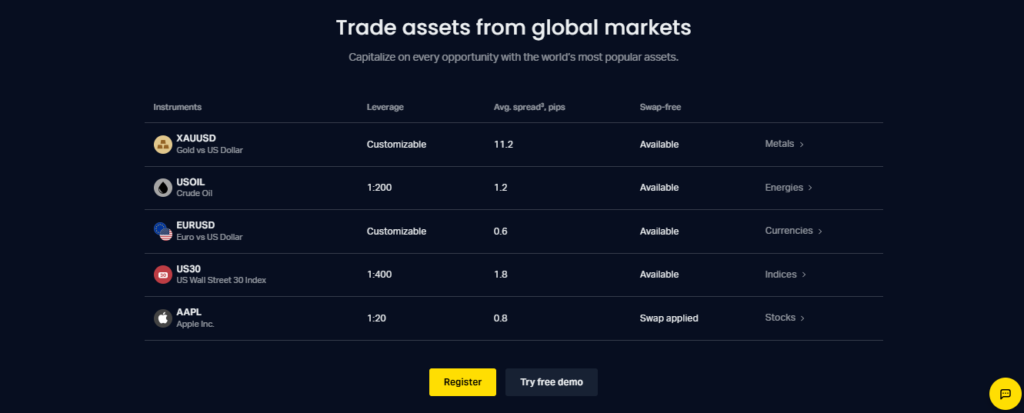

Beyond a wide selection of currency pairs, Exness offers a comprehensive range of trading instruments to suit various market interests. These include Forex, Gold & Silver, CFDs, Oil, Stocks, Indices, Metals, Energies, Cryptocurrencies, and other commodities, providing ample opportunities for active traders.

It’s important to note that each asset class comes with its own specific trading conditions, such as spreads, leverage, and margin requirements. Therefore, it’s essential to ensure your trading strategy aligns with the characteristics of the instrument you choose.

Exness is particularly attractive to forex traders thanks to its robust offering, which includes:

-

107 currency pairs

-

81 stocks and indices

-

13 cryptocurrencies

-

12 commodities and energy assets

The broker continues to expand its product range, having introduced CFDs on shares in 2020, further enhancing its appeal to traders interested in equity markets.

However, it’s worth mentioning that Exness does not support passive investment options such as ETFs, PAMM accounts, or other long-term investment products. As such, while it’s an excellent platform for active traders and forex enthusiasts, those seeking passive income solutions might find its offerings somewhat limited.

Overall, if you’re looking for a diverse and flexible trading environment, especially in Forex and CFDs, Exness stands out as a strong and reliable choice.

Payment Methods

When ing a forex broker, deposit and withdrawal features are some of the most important things to consider as it can easily affect the trades. In Exness, you can deposit and withdraw via Wire Transfer, credit/debit cards, Neteller, and Skrill. The processing time basically depends on the payment option you choose, ranging from several minutes to several days. Some payment systems support instant withdrawal.

The minimum and maximum amount of deposit/withdrawal also depend on the payment system so make sure to keep an eye on that. The broker initially doesn’t charge any commission for deposit or withdrawal, but certain fees can be charged from the third party. Lastly, keep in mind that the name on the trading account should be the same as the one in the payment processor, as stated in the AML regulations.

Trading Platforms

Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, a price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitability by placing well-planned trades.

Hereby, Exness offers you MetaTrader 4, MetaTrader 5, Social trading and Web.

The platforms are accessible for desktop and webtrader via Windows, Mac, Linux, and also available for mobile devices.

Unique Features

With over twelve years of industry experience, Exness has established itself as one of the leading global brokers, consistently evolving and enhancing its services to meet the needs of all types of traders. While some features may not always outshine competitors, Exness compensates with a wide array of unique and valuable offerings that set it apart in other areas.

One standout feature is Exness’ in-house VPS (Virtual Private Server) hosting, available to clients with a minimum account balance of $500. This is a reasonable threshold considering the significant advantages the service offers.

A VPS allows traders to connect to a remote terminal located near Exness’ trading servers. This proximity ensures a stable, uninterrupted trading environment, protecting users from common technical disruptions like power outages or internet connectivity issues. With ultra-fast execution speeds ranging from 0.4 to 2.5 milliseconds, traders benefit from near-instant order execution and real-time quote delivery, enhancing both performance and reliability—especially for high-frequency and automated trading strategies.

Education and Research

Exness offers a wide range of features that are aimed at both beginners and advanced traders. When it comes to educational and research materials, Exness provides excellent in-house content for its clients. To begin with, there is the Weekly Forex Data segment which consists of in-depth analysis about price in the key upcoming events and trading ideas. There’s also the bi-weekly technical analysis with quality content and charts. In addition, Exness offers a web TV stream provided by Trading Central to add research value. Completing the package is a live news feed.

Customer Support

Do you have any question or find any trouble related to Exness? If you do, you should reach Exness’s support to get the information that you need. Here is the detail of the broker’s customer support:

Exness provides a rather high-quality multi-lingual support that is accessible via e-mail and phone. The main information on the website is available in more than 10 languages, while the customer service itself is supported in 15 languages. However, only English, Chinese, and Thai language operate 24/5. That is why it’s best to check the availability of each language before you contact the broker so there won’t be any. You can also just go to the Help Center section on the website to find answers to commonly asked questions.